- Failory

- Posts

- $600M on Bugs

$600M on Bugs

How Ynsect built an insect giga-factory too early

Hey - It’s Nico.

Welcome back to Failory after our two-week Christmas break.

Here are the three key takeaways from today’s edition:

Ynsect, an insect meat startup, has shut down — learn why below

What's working in SaaS pricing right now

The AI trends for 2026 — see what they are below

A huge thanks to today’s sponsor, Playbookz. Be sure to grab their deal while it's live!

LinkedIn demand gen that books meetings AD

Playbookz helps founders turn LinkedIn into a consistent source of conversations with buyers. They handle everything: weekly content, outbound DMs, and ads.

That means:

• more qualified meetings booked

• more “I’ve been following you” inbound

• more trust built before the first call

• less pressure to “go viral” to see results

The behind-the-scenes work includes weekly posts, targeted outreach, and DM-first ads, but the benefit is super straightforward: reliable demand gen without founder overwhelm.

Book a no-obligation call to see if it fits. Failory readers get $1,000 off their first month.

This Week In Startups

🔗 Resources

What's working in SaaS pricing right now

Everything is Computer: the production model of the future

Authority Is the AI Bottleneck

Delve’s AI Copilot automates SOC 2, HIPAA, and ISO compliance, saving you time and accelerating audits. *

📰 News

Disney+ is launching short-form videos this year

Amazon’s AI assistant comes to the web with Alexa.com

Nvidia launches Alpamayo, open AI models that allow autonomous vehicles to ‘think like a human’

Meta bought Manus AI

💸 Fundraising

Anthropic reportedly raising $10B at $350B valuation.

xAI Raises $20B Series E

Clinical voice AI startup Tucuvi raises $20M

AI evaluation startup LMArena raises $150M at $1.7B valuation

* sponsored

Fail(St)ory

Ynsect Meat

Ynsect was supposed to be the company that made bug protein mainstream. It raised over $600 million and still ran out of road. This week, the French startup entered judicial liquidation.

If you remember the name, that’s not an accident. Ynsect had celebrity buzz, state backing, and a climate-friendly story that fit the moment perfectly.

What killed it was a series of very expensive decisions made before the business was ready.

What Was Ynsect:

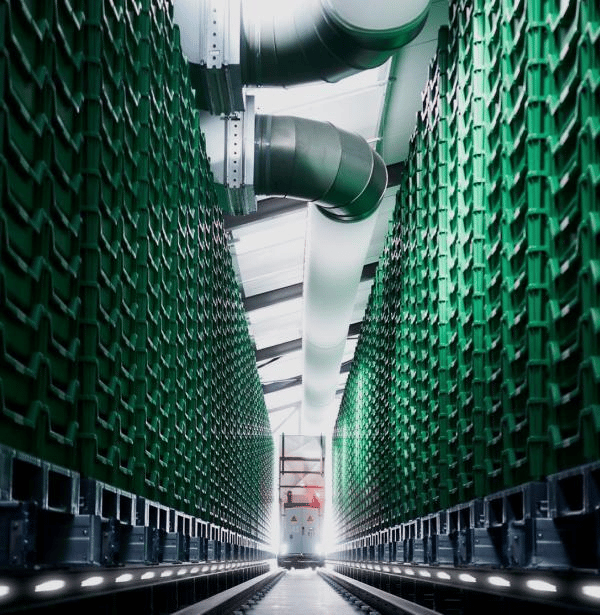

Ynsect started in France in the early 2010s, when insect protein was already a known idea but still small-scale. The company aimed straight for industrial production.

The model centered on farming mealworms in controlled facilities and turning them into protein and oil. Those ingredients were sold mainly into animal feed, with pet food as a secondary outlet.

To compete, Ynsect invested early and heavily. Vertical systems, climate control, automation, custom plants. Most of the spending happened before demand was proven.

Animal feed was the first real target. It is the largest protein market and shaped how Ynsect designed its production. Insect protein was positioned as a substitute for fishmeal and soy.

However, the company stayed in animal feed longer than the economics allowed. Sustainability mattered to investors, but feed buyers still bought on price. Insect protein added cost where there was no margin for it.

Pet food emerged as a second path. It was less price-driven and offered better margins, making it a more workable market for insect protein. Ynsect kept both markets running at the same time.

That meant one cost structure serving two different businesses. The expectation was that scale would eventually fix animal feed while pet food supported margins. It never did.

In 2021, Ynsect acquired Protifarm and moved into human food ingredients. Revenue peaked at €17.8 million that same year, far below what the infrastructure required. Losses grew as more capacity came online.

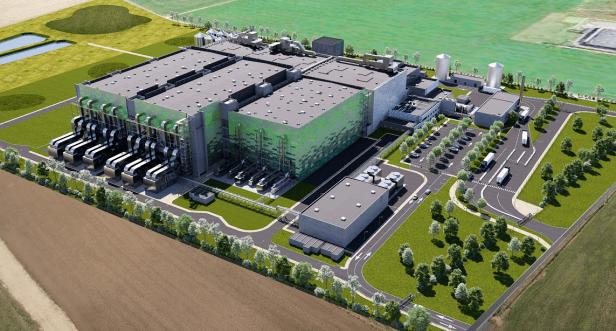

The biggest bet was Ÿnfarm in northern France. Hundreds of millions went into a facility built for high-volume animal feed. That decision fixed the company’s strategy in place.

When demand fell short, Ynsect cut jobs and shut smaller sites. The main cost base remained. Cash ran out soon after.

The Numbers:

💰 Capital raised: $600M+

📈 Peak revenue: €17.8M in 2021

🔻 Net loss: €79.7M in 2023

🏭 Big bet: Ÿnfarm giga-factory

Reasons for Failure:

Strategic indecision baked into the org: Ynsect never chose its customer with enough conviction. Animal feed, pet food, and human food each demand different economics and execution. Trying to keep all three alive slowed every decision. The Protifarm deal added surface area without adding near-term cash.

Sustainability did not change buyer behavior: The climate story resonated with investors, regulators, and the public. It did not move purchasing managers in animal feed. Price per kilo still ruled. Insect protein could not beat incumbents at scale. No amount of impact framing fixes that.

Building the factory before proving the model: Ÿnfarm locked Ynsect into a capital-heavy path early. Hundreds of millions were spent before unit economics were stable. Once the plant was built, flexibility disappeared.

A correct pivot that arrived too late: Focusing on pet food was the right call. It just came after irreversible bets were placed. By the time margins were prioritized, costs were fixed. Late clarity is still clarity, but it is rarely survivable.

Why It Matters:

Factories freeze your customer choice. Ynsect’s plant was built for animal feed volumes, which made later shifts toward pet food harder.

Commodity buyers surface cost problems immediately. Animal feed pricing left no room to hide unproven unit economics.

Trend

AI Trends for 2026

It’s January, which means founders and analysts are publishing 2026 predictions like it’s cardio.

Most of it is junk. AGI timelines, apocalypse timelines, and the same “AI will change everything” line with different fonts.

Still, a few predictions repeat across credible places. When the same themes show up from Microsoft, IBM, MIT, Altman and Karpathy, it’s usually because teams are already spending money in that direction.

Prediction 1: AI becomes central to research

We already have a few clean cases where AI produces outputs researchers can use without squinting.

AlphaFold is the obvious one: DeepMind says it has predicted over 200 million protein structures and made them broadly available through the AlphaFold database.

In materials, DeepMind’s GNoME work reports 2.2 million candidate crystals and roughly 380,000 to 381,000 predicted stable structures, which expands the search space for what labs might synthesize next.

AlphaTensor found new matrix multiplication algorithms that beat prior approaches for certain sizes.

AlphaDev discovered faster small sorting routines that got integrated into LLVM’s standard C++ sorting library.

What experts are betting is that this becomes a repeatable workflow, not a set of one-off wins. Peter Lee at Microsoft Research explicitly frames 2026 as AI generating hypotheses, using tools that control experiments, and collaborating with researchers, basically “joining the process of discovery.”

Altman puts a sharper stake in the ground: “2026 will likely see the arrival of systems that can figure out novel insights.”

Prediction 2: Multi-agent systems move into production

I think 2026 is when multi-agent setups move from “a cool pattern” to the default for complex work, and agents start coordinating with each other through shared protocols.

This is already headed that way.

Microsoft’s AutoGen is explicitly built around multiple agents conversing to accomplish tasks, not one agent doing everything.

Anthropic has published how they built a multi-agent research system, which is basically a real-world example of “handoffs” between specialist roles.

Google introduced an Agent2Agent protocol (A2A) specifically for agents to communicate, exchange information securely, and coordinate actions across platforms.

If this holds, teams stop wiring every system as a one-off. They plug agents into a common “talk to other agents” layer, then worry about governance, security, and tracing who told who to do what.

Prediction 3: Health AI gets productized for consumers

According to a recent analysis by OpenAI, healthcare questions are one of the most common things people use ChatGPT for. They say over 230 million people globally ask health and wellness questions on ChatGPT every week.

Before the start of the year, Microsoft researchers predicted that in 2026, “AI is poised to shrink the world’s health gap,” moving beyond diagnostics into things like symptom triage and treatment planning, and showing up in products used by millions.

Well, it seems Microsoft was right on this one because a couple of days ago OpenAI launched ChatGPT Health. It’s a dedicated Health space inside ChatGPT where you can connect medical records and wellness apps like Apple Health and MyFitnessPal, so it can help you understand test results, prep for doctor visits, and make sense of options like insurance tradeoffs.

I think this keeps expanding in 2026 because there’s still a lot of healthcare work that AI can realistically take on: clinic triage, documentation, follow-ups, and decision support inside existing systems.

Prediction 4: Shopping shifts toward chat interfaces

I’ve been banging on this for a while. In November I discussed AI-Powered Shopping and said that assistants can’t be good shoppers without infrastructure like clean catalogs, reliable pricing and inventory feeds, and merchant APIs they can actually hit.

This is already moving from theory to product.

Amazon built Rufus directly into the Amazon app and desktop experience, trained on its catalog, reviews, and Q&A, and positions it as a conversational way to compare products and get recommendations.

Google is pushing the same direction in Search: conversational shopping in AI Mode, responses that include price and reviews, and even “agentic checkout” plus an AI that calls local stores for inventory.

MIT Technology Review’s writers are basically calling this becoming normal behavior: a chatbot that recommends, compares, finds deals, and increasingly handles the boring parts of buying.

Help Me Improve Failory

How useful did you find today’s newsletter?Your feedback helps me make future issues more relevant and valuable. |

That's all for today’s edition.

Cheers,

Nico