- Failory

- Posts

- Eaten by the Big Platforms

Eaten by the Big Platforms

Carted wanted to unify e-commerce, TikTok had other plans.

Hey - It’s Nico.

Welcome to another Failory edition. This issue takes 5 minutes to read.

If you only have one, here are the 5 most important things:

Carted, a startup that wanted to unify online shopping, has shut down — learn why below

Non-obvious pricing advice for startups

OpenAI completes its for-profit recapitalization

Legaltech AI startup Legora raises $150M at $1.8B valuation

TechCrunch Disrupt 2025 wrapped up yesterday — below are the key startup trends that stood out.

This Week In Startups

🔗 Resources

Why pitches fail (and a template that will fix yours).

What’s working in GTM right now.

Non-obvious pricing advice for startups

How founders should think about runway: A guide from Sequoia Capital

📰 News

Two days after OpenAI’s Atlas, Microsoft relaunches a nearly identical AI browser

OpenAI made ChatGPT better at sifting through your work or school information.

Canva launches its own design model

OpenAI completes its for-profit recapitalization

💸 Fundraising

Legaltech AI startup Legora raises $150M at $1.8B valuation

Helex raises $3.5M to advance gene therapies for kidney diseases

AI video startup Synthesia raises $200M at $4B valuation

AI startup Mercor now valued at $10 billion with new $350 million funding round.

Fail(St)ory

Universal e-commerce

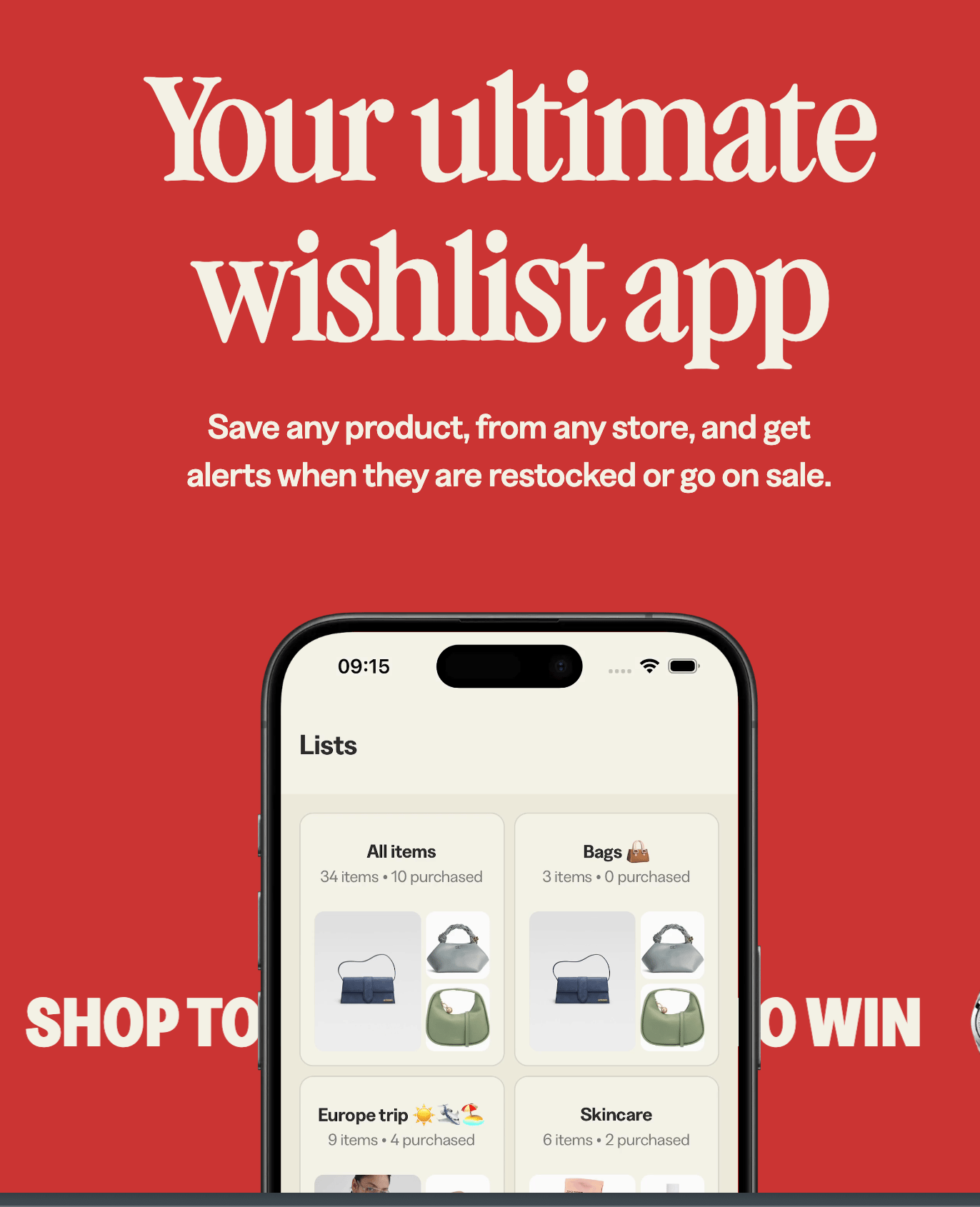

Carted set out to unify online shopping under one “universal e-commerce API”. It then pivoted into a price-tracking app — and now, it’s shutting down.

What Was Carted:

Carted raised $13M in 2021 to solve a real, obvious pain: when you see a product online (in a video, a blog, a social feed), buying it is still very messy. You get bounced across tabs, stores, affiliate links, and sketchy Shopify pages. The founders wanted to erase all that.

They built a system that let publishers, apps, and platforms drop a universal “buy” layer right on top of the content. You could check out without ever leaving the page. Carted handled all the backend chaos: connecting to different merchants, splitting orders and tracking affiliates.

If it worked, every article, video, or post could instantly turn into a small marketplace. The idea made perfect sense, until the platforms did it themselves.

By 2023, TikTok and Instagram had rolled out native shopping. They didn’t need Carted’s API, they built their own. The platforms kept the user, the product, and the payment in-house.

So Carted pivoted. They turned the underlying tech into a consumer app instead. Now anyone could save products from across the internet, organize them into folders, compare options, and get price drop or restock alerts. Think Pinterest meets Honey.

The app launched in 2024 and found early fans. It solved a genuine pain: the chaos of modern shopping spread across 20 tabs and half a dozen stores. But like most consumer tools that live between discovery and checkout, it was easy to like and hard to monetize.

The Numbers:

🗓️ Founded: April 2021

💰 Seed Round: $13M (one of Australia’s largest seeds)

👥 Team Cut: 14 → 6 during 2023 build

🧪 Pivot: API to consumer price tracker app

📲 App Launch: 2024, with engaged early adopters

Reasons for Failure:

Big platforms got there first: TikTok Shop rolled hard from 2023 onward, and Instagram had already put checkout inside the feed back in 2019. At the same time, publisher-side competitors showed up with on-page checkouts, like Bolt buying Tipser to let readers buy “on any digital surface.” And even where full checkout wasn’t needed, link-in-bio and affiliate pipes were good enough for creators and media: Linktree’s Store Link pushed shoppable listings right in bio.

The pivot weakened the business model. The consumer app was clean and useful, but alerts, lists, and sharing are easy to clone and hard to monetize at scale. If you don’t control the checkout, you don’t control the take rate. Without a crisp plan for merchant SaaS, affiliate unit economics, or paid features, growth becomes marketing spend. A pivot should shorten the path to cash, not just to love.

Timing collided with AI-led, agentic shopping. The narrative moved toward agents that generate options, compare prices, and place orders across stores. That shift made “universal API” feel like yesterday’s layer. It also hit fundraising and partnerships, because buyers and investors chase where demand is created, not where it is forwarded.

Why It Matters:

Don’t build on borrowed distribution. If your product depends on platforms that can replace you with a feature toggle, you don’t have a moat, you have a countdown.

If you pivot to consumer, lock the revenue model on day one. Don’t wait for scale to set pricing. Decide your take rate, SaaS fee, or premium features early.

Solve a pain, not a friction. Frictions get engineered away by whoever owns the platform. Pains stick around long enough to build a company on.

Trend

The Trends of TechCrunch Disrupt

TechCrunch Disrupt 2025 wrapped up yesterday, and while everyone’s talking about who won, the real story is what the 200 startups in the Battlefield revealed about where founders’ heads are right now.

Forget the stage lights. Disrupt has always been a mirror for the broader startup psyche. This year’s reflection was clear: AI has eaten everything, climate tech is getting real, and “deep tech” isn’t dead, it’s just learned to sell.

Why It Matters:

AI is no longer a vertical, it’s infrastructure. The same way cloud became a baseline a decade ago, AI is now just the expected layer under everything. Startups that don’t use it stood out for being the exception.

Investors are rewarding “real-world tech.” The winners weren’t building the metaverse or minting tokens. They were moving shipping containers, recycling plastic, or curing kidney disease.

1) AI Everywhere (and in Everything)

Unsurprisingly, every second booth was an AI company, even when it wasn’t. Out of 200 startups, at least 18 were formally “AI/ML,” but nearly all the rest had AI baked in somewhere.

Finalist Elloe AI is the perfect example. They call themselves the “immune system” for enterprise AI, building a compliance layer that fact-checks and sanitizes outputs before they hit production. It’s a bet that “AI safety” will be the next compliance goldmine.

Unthread is another Top 20 startup, turning messy Slack threads into auto-resolved tickets using large language models. The pitch: stop drowning in internal noise.

Super Teacher, meanwhile, showed what happens when AI tutors actually talk back: its animated, voice-based teachers are already live in public schools for $15 a month.

AI showed up in logistics, education, and even testing software updates (CyDeploy clones entire IT environments with machine learning to safely deploy patches).

The crypto/Web3 crowd? Nowhere. It’s clear founders have moved from tokens to transformers.

2) SaaS Still Sells

SaaS was the single biggest category at Disrupt (30 of 200 startups), but the winners were hyper-specific, built by domain insiders who know the pain firsthand.

Identifee, a finalist, is a good example. Built by ex–Wells Fargo execs, it’s an all-in-one productivity platform for bankers: CRM, analytics, and AI in one interface.

ExoMatter is another example. It is a materials-informatics SaaS that helps R&D teams search, simulate, and source alternative materials to cut cost or emissions. It’s literally a lab-insider product: founded by a PhD materials chemist and spun out of the German Aerospace Center (DLR).

3) Climate Tech Becomes Core Business

At least a dozen companies tackled sustainability directly, and one of them, MacroCycle, made the final five. Their pitch: take end-of-life plastics and textiles and recycle them back into petrochemical-grade material with zero emissions. Circular economy, finally with a business model.

Chile’s Strong by Form joined the Top 20 by building lightweight engineered wood that can replace concrete and steel. It’s cheaper, carbon-negative, and quite pretty.

COI Energy built a platform that lets businesses monetize their energy waste. Large buildings often buy excess electricity capacity they never use; COI’s system allows them to sell or share unused electricity in real time to others on the grid.

4) Deep Science Steals the Show

The Battlefield’s biggest surprise: the top two startups weren’t SaaS or social—they were science.

The winner, Glīd, built an electric vehicle that moves shipping containers from port to rail, replacing diesel trucks. Cleaner, faster, more efficient. Industrial logistics, reimagined.

Runner-up Nephrogen is working on AI-driven gene therapy for kidney disease. Founder Demetri Maxim, who actually lives with the disease, plans to join his own clinical trials. It’s biotech meets founder-market fit in the rawest way possible.

Meanwhile, Mbodi, another finalist, showed how to teach robots new tasks with plain English. Chipiron is rebuilding MRI machines to make them portable and cheap.

All of them point to the same trend: deep tech isn’t dead, it’s finally consumerizing.

Help Me Improve Failory

How useful did you find today’s newsletter?Your feedback helps me make future issues more relevant and valuable. |

That's all for today’s edition.

Cheers,

Nico