- Failory

- Posts

- Right When It Worked

Right When It Worked

Why Botkeeper shut down when its tech finally delivered

Hey - It’s Nico.

Welcome to another Failory edition. This issue takes 5 minutes to read.

If you only have one, here are the 5 most important things:

Botkeeper, an AI bookkeeping startup, shut down a week ago — learn why below.

China’s top AI labs just dropped a bunch of AI models — learn which ones matter the most below.

A huge thanks to today’s sponsor, Deel. Win $1M for your startup with a 2-minute pitch!

Win $1M for your startup – Pitch in 2 minutes AD

The Pitch by Deel is here.

We’re giving away $1M in investment to founders with the most promising ideas.

No warm intros and no fees. Just a pure competition for the best entrepreneurs.

Whether you're just starting or scaling, this is your chance to get the capital you need. Pitch in 2 minutes and join the competition that’s changing how startups get funded.

This Week In Startups

🔗 Resources

The B2B revenue opportunity hiding in plain sight.

In Defense of Vertical Software.

What AI image and video generation unlocks for lean teams *

📰 News

Cohere launches a family of open multilingual models.

OpenClaw founder Peter Steinberger joins OpenAI.

GPT‑5.2 derives a new result in theoretical physics.

Gemini can now create music with Lyria 3.

💸 Fundraising

New AI startup Ineffable Intelligence reportedly raising $1B funding round.

World Labs raises $1 Billion to scale spatial AI.

Biotech startup raises $175 million to advance Alzheimer’s antibody therapy.

AI chip startup Taalas raised $169 million to take on Nvidia

* sponsored

Fail(St)ory

AI Bookkeping

Botkeeper is dead.

After 11 years and almost $90 million raised, the AI bookkeeping startup shut down a week ago.

Botkeeper was one of the better-known “AI for accounting” bets of the last decade. And according to its CEO, the tech worked. The market just moved faster.

Let’s unpack that.

What Was Botkeeper:

Botkeeper was founded in 2015 by Enrico Palmerino. The pitch was simple: bookkeeping is repetitive and rule-based, so machines should handle most of it.

From day one, they branded themselves as “the future of bookkeeping.” The mission was to modernize a conservative, compliance-heavy industry that still runs on spreadsheets and manual reconciliation.

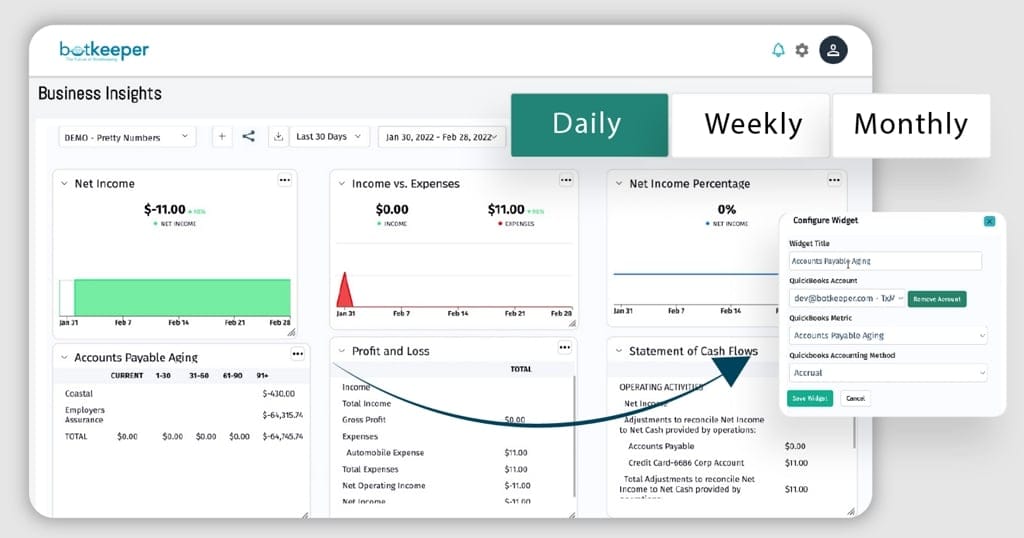

The core product automated transaction categorization, reconciliations, and the monthly close. The goal was to remove the grunt work and let accountants focus on higher-margin advisory.

But this was never pure SaaS.

Botkeeper ran a hybrid model: machine learning plus a layer of skilled accountants who handled exceptions, reviewed outputs, and kept accuracy high. Automation did the heavy lifting. Humans made sure it didn’t break.

By late 2021, the company had raised $90 million and claimed 200+ accounting firms and 5,000+ small businesses on the platform.

Then came the product evolution.

In 2023–2024, they launched Botkeeper Infinite, a tech-only version of the platform. No bundled outsourcing. Just the software.

And by the end of 2025, Palmerino claimed they had finally cracked it. The system could clean up years of messy books in minutes, code more than 80 percent of transactions with 98 percent accuracy, reconcile accounts autonomously. The original vision from 2015, machines doing the work, was finally real.

Then, almost immediately, they shut it down.

Not during the messy early years. Not when the model was half-baked. Right when the product was supposedly at its peak.

So if the tech finally worked, what actually broke?

The Numbers:

💰 Total funding: ~ $89–90 million

📅 Founded: 2015

🏢 Customers claimed (2021): 200+ accounting firms, 5,000+ SMBs

💵 Infinite pricing: starting at $69 per client

Reasons for Failure:

Industry consolidation hit their biggest clients: This is the CEO’s explanation. In his shutdown letter, Palmerino says a wave of unexpected consolidation in late 2025 impacted their largest accounting firm clients and changed their financial outlook in a matter of weeks. When those firms merged or restructured, revenue shrank fast, and the company couldn’t course-correct in time.

The product was strong. The fit wasn’t strong enough: Palmerino admits it directly: “we did not reach a level of product-market fit strong enough to withstand rapid industry shifts or changing market conditions before our time ran out.” The tech improved, but it wasn’t embedded deeply enough to survive client mergers and budget resets. If customers can drop you during consolidation, you are useful, not indispensable.

The business was mid-transition: They had spent years selling a hybrid model of software plus human support, then shifted with Infinite toward a tech-only platform. That kind of model transition takes time to reshape margins, positioning, and customer behavior. The product may have been at its strongest, but the business model was still evolving when the revenue shock hit.

Why It Matters:

Hitting the original product vision is not the same as building a durable company.

Customer structure can be a bigger risk than technical risk.

Trend

China’s AI Sprint

It’s Lunar New Year.

While a lot of people are offline, China’s AI labs decided to ship half the future.

Within days, the biggest players dropped new flagship models. LLMs, Video generators and Agent upgrades.

Lets unpack them.

Seedance 2.0

ByteDance (TikTok) dropped Seedance 2.0, a next-gen audio plus video generation model with text, image, audio and video inputs.

What stood out was how much they leaned into control. Seedance is built around references and editing workflows. You can steer it. Iterate. Adjust style, motion, cuts. It feels less like a slot machine and more like a creative tool.

That’s why it went viral. When creators feel they can direct the output instead of gambling on prompts, they share results.

The positioning is clearly production-oriented. Motion quality. Scene interaction. Coherence. Controllability. These are the pain points that made earlier text-to-video models unusable in real workflows.

Qwen 3.5

Alibaba Group just released Qwen 3.5, the latest version of its open-weight large language model. If you don’t follow Qwen closely, here’s what matters.

First, it’s open under Apache-2.0. That means you can download it, fine-tune it, host it yourself, and ship products without waiting for API access. That alone drives fast adoption.

Second, Alibaba pairs that with a hosted “Plus” version that offers long context and built-in tools. So hobbyists and startups can experiment for free, and serious teams can pay for a stable, managed version.

They also push the “agent” angle hard. Qwen 3.5 is framed as capable of operating across mobile and desktop apps, handling bigger workloads, and executing multi-step tasks.

GLM-5

Zhipu AI introduced GLM-5 as a new flagship model.

It’s released under an MIT license and positioned for coding, long-horizon tasks, and agent workflows.

GLM-5 is showing up at the top of open-weight leaderboards and posting strong results on coding benchmarks like SWE-bench Verified. That puts it in serious territory for developers evaluating open models.

In practical terms, this means you now have an open model that competes closely with top closed systems on engineering-heavy tasks.

A lot of people are already comparing it to Claude Sonnet 4.5-level performance on coding and agent benchmarks, which is really good news for the Chinese startup.

Help Me Improve Failory

How useful did you find today’s newsletter?Your feedback helps me make future issues more relevant and valuable. |

That's all for today’s edition.

Cheers,

Nico