- Failory

- Posts

- The Rickshaw Lenders

The Rickshaw Lenders

How an EV startup ended up funding three‐wheel taxis.

Hey — It’s Nico.

Welcome to another Failory edition. This issue takes 5 minutes to read.

If you only have one, here are the 5 most important things:

Ohm Mobility, a startup trying to fix financing in the EV industry, shut down — learn why below.

What GTM teams are doing with ChatGPT

Google is testing a vibe-coding app called Opal

PlayerZero raises $15M to prevent AI agents from shipping buggy code

Two Chinese startups just launched SOTA open-source AI models — learn more below.

This issue is brought to you by dofollow.com — the link and citation building agency that helps your startup rank on Google, ChatGPT, Perplexity, and Gemini.

If AI or Google Can’t Find You, Neither Will Your Customers.AD

In 2025, AI and Google decide who gets seen—and who gets ignored. If your SaaS site isn’t earning backlinks from trusted, high-authority sites, you’re invisible when it matters most.

That’s where dofollow.com comes in.

We help SaaS companies land editorial niche-relevant backlinks from high authority websites—fast.

You’ll work directly with a strategist to build real authority and rank for the keywords your buyers are actually searching.

Here’s what you get:

High-authority backlinks from real, relevant sites

A dedicated niche expert strategist

Link monitoring + free replacements

No long-term contracts—just compounding growth

Used by Surfshark, Wiz, Pitch, and Heymarket.

This Week In Startups

🔗 Resources

How to rank content that ranks with LLMs

What GTM teams are doing with ChatGPT

Vibe Analysis: AI is coming for Data Analysis

Max MRR: Your growth ceiling

📰 News

OpenAI launches Study Mode in ChatGPT

Google Chrome adds AI-powered store summaries to help US shoppers

Sam Altman warns there’s no legal confidentiality when using ChatGPT

Google is testing a vibe-coding app called Opal

💸 Fundraising

PlayerZero raises $15M to prevent AI agents from shipping buggy code

Israeli cybersecurity startup Noma Security raises $100 million

Greek defence tech startup founded by Apple roboticist raises $14M

Dropzone AI raises $37M to supercharge its ‘AI SOC analyst’ security software

Fail(St)ory

EV Lenders

A few days ago, Ohm Mobility, a startup trying to fix one of India’s biggest EV bottlenecks—financing—officially shut down.

After five years of experiments, pivots, and trying to find product-market fit, the team called it quits.

What Was Ohm Mobility:

At its core, Ohm was trying to solve a big problem in the Indian electric vehicle market: how to get more financing for EVs.

EVs are expensive, especially for the small fleet operators and gig workers driving most of the adoption in India. Banks and lenders are hesitant to issue loans because they don’t trust the resale value or longevity of EVs, which makes financing hard to access.

Ohm’s pitch was to bridge that gap. The team built a platform to connect EV players—fleet operators, manufacturers, battery leasing firms—with institutional capital. They tried to make EVs more “bankable” by using IoT data from vehicles to show lenders how the EVs were being used, whether they were in good shape, and how likely it was that the loan would be paid back.

To strengthen its backend, they even acquired a company called CloudNBFC, which gave them better loan management tech. The goal was to build the Stripe of EV financing—plug in your data, unlock loans.

However, the team soon realized this model was hard to scale. In 2023, they pivoted.

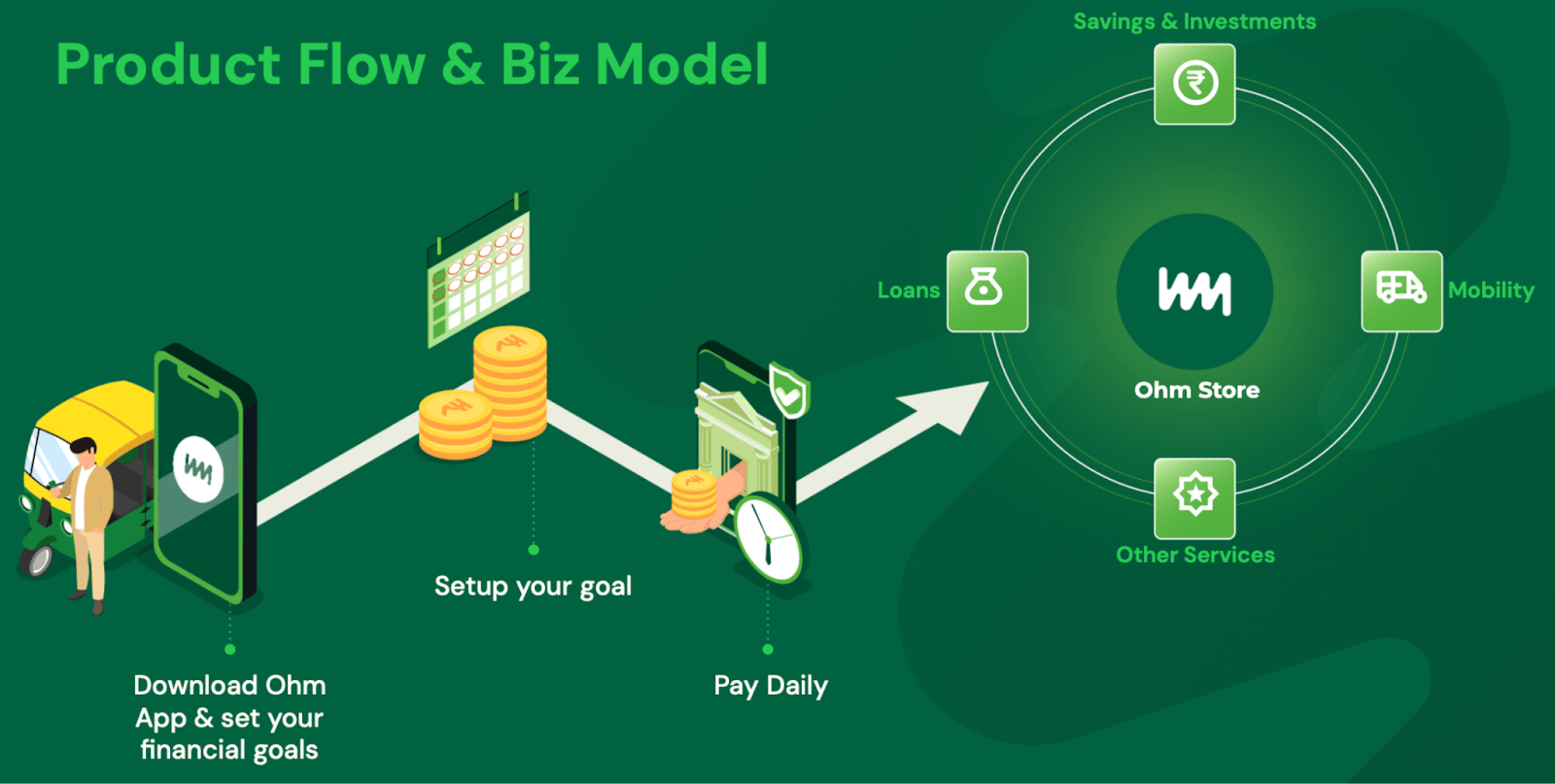

Ohm Mobility became Ohm Daily. The new plan was to focus on financial products for gig workers—auto drivers, delivery folks, mobility freelancers. They launched tools to help these workers manage daily earnings and access microcredit. It was a bold shift toward a more tangible user base, but one that came with a whole new set of problems.

The Numbers:

📅 Founded: 2020

💰Capital raised: ~$340K

🔁 Pivot & rebrand: 2024, to “Ohm Daily”

👥 Final target market: Gig workers, including rickshaw drivers

📉 Shutdown: 2025, after failing to scale any business model

Reasons for Failure:

No Clear Product-Market Fit: Ohm started with a high-level platform play—connecting banks with EV businesses using real-time vehicle data. In theory, this made sense. In practice, adoption was slow. The founder Nikhil Nair said in a LinkedIn post that they couldn’t “crack the model that could scale and sustain”.

Pivots That Didn’t Land: The shift to Ohm Daily made sense on paper. The gig economy is huge, and its workers are wildly underserved by traditional banks. But underserved doesn’t always mean easy to serve. Acquiring low-income users is tough. Retaining them is even tougher. The pivot came too late, and with too few resources to fully figure it out.

Complex Product in a Messy Market: Ohm was trying to fix EV financing with a mix of tech, IoT data, and partnerships with banks. That meant dealing with a lot of moving parts—lenders, leasing companies, vehicle makers, and hardware providers. That mess made it slow and expensive to roll out, especially for a small startup without deep pockets.

Limited Capital in a Hard Market: They raised just $340k total. That might work if you’re building a simple SaaS tool. But EV finance? That’s a capital-intensive space that demands patience and runway. Ohm was playing in a big league without big league funding.

Why It Matters:

Big markets can still be bad fits – Even huge, obvious problems can be too hard for a small startup to solve.

Don’t split your target – Serving two very different customer types is a focus killer.

Pivots can swap one hard problem for another – Change direction, but make sure the new road is easier.

Trend

China Just Dropped Two Open-Source AI Bombs

In the last two weeks, two Chinese startups quietly did something that could shake up the AI race.

Moonshot AI dropped Kimi K2, a trillion-parameter beast of a model. Then Z.ai followed with GLM‑4.5, a model that’s smaller, cheaper, and built with “agent-native” smarts baked in.

Both are open-source. Both perform extremely well. And both are priced to undercut big Western players.

If you’re running a startup, building AI products, or just watching the global AI race unfold — these launches are worth your attention.

Why It Matters:

Cheaper power tools – Startups can now tap models that rival Anthropic or OpenAI in reasoning and coding skills at a fraction of the cost.

No vendor lock‑in – Open weights mean you can self‑host, fine‑tune, and integrate without worrying about API changes or pricing whiplash.

Global competition is heating up – This isn’t just catching up — China is innovating in LLM architecture in ways that could set the tone for the next wave of AI products.

Kimi K2

Moonshot AI, a Beijing startup founded in 2023 and backed by Alibaba, launched Kimi K2 on July 11. On paper, it’s massive: 1 trillion total parameters, but with a Mixture‑of‑Experts setup so only 32B are active at any moment. This gives you heavyweight reasoning ability without frying your GPUs.

It comes with a 128k context window (same size as GPT4o). That means you can feed it a whole novel, a huge dataset, or a multi-step workflow without chunking or hacking around length limits.

It’s fully open‑source, with weights and code freely available under a permissive license, so anyone can run it, fine‑tune it, or build products on top without asking permission.

Performance‑wise, it scores extremely well in coding and math tests — often beating other non‑reasoning open‑source models and in some cases matching closed models from the West.

It’s important to note that Kimi K2 is not a “reasoning” model in the style of GPT‑o3 or other slow‑thinking LLMs. It’s designed for fast, reflex‑style answers, making it ideal for things like code generation, structured data work, and AI assistants that need to act quickly rather than deliberate.

Z.ai

Two weeks later, Zhipu AI reintroduced itself to the world as Z.ai, launching GLM‑4.5 at the World AI Conference in Shanghai. While smaller than Kimi K2 (355B total parameters, 32B active), it’s designed differently. This is an “agent-native” model — meaning reasoning and action‑taking are part of its DNA, not bolted on afterwards.

It breaks down big problems into smaller sub‑tasks and executes them in sequence — perfect for multi‑step workflows like research, data cleaning, and process automation. In agentic benchmarks, it ranks alongside Claude 4 Sonnet, and it beats most competitors on cost.

Like Kimi K2, GLM‑4.5 is fully open‑source, available on GitHub and Hugging Face. And it’s fast — the smaller GLM‑4.5‑Air variant offers even lower latency for real‑time use cases.

What This All Means

The easy take is “China is catching up.” The more interesting take is that China is competing differently.

Instead of locking models behind APIs like OpenAI, both Moonshot and Z.ai are betting on open access. This isn’t just about goodwill — it’s a calculated move to:

Build global developer mindshare.

Create ecosystems of apps, fine-tunes, and integrations around their models.

Undercut proprietary players on cost.

The real value for founders?

Freedom to build without gatekeepers – If OpenAI changes its API terms, you’re stuck. If Kimi K2 or GLM‑4.5 are self‑hosted, you keep control.

Room to specialize – You can fine‑tune for legal, finance, medical, or niche technical use cases without asking permission.

Lower starting costs – Even if you still need cloud GPUs, your inference bill could be far lower than proprietary alternatives.

Help Me Improve Failory

How Was Today's Newsletter?If this issue was a startup, how would you rate it? |

That's all of this edition.

Cheers,

Nico