- Failory

- Posts

- When Mergers Blow Up

When Mergers Blow Up

How a 12-year startup died overnight

Hey - It’s Nico.

Welcome to another Failory edition. This issue takes 5 minutes to read.

If you only have one, here are the 3 most important things:

Sendle, a shipping startup for small businesses, has shut down — learn more below

The 6 GTM problems that keep repeating.

AI agents are good enough that teams are starting to build instead of buy software — learn why this matters below

And huge thanks to today’s sponsor, Deel. Get their guide to scale a remote-first company!

A founder’s guide to scaling globally AD

Build and scale a remote-first company with confidence.

This guide helps founders navigate global hiring, compliance, payroll, compensation, and culture, with a practical roadmap to grow internationally without losing speed or control.

This Week In Startups

🔗 Resources

The 6 GTM problems that keep repeating.

Everyone can have their own AI CRM.

It's time for agentic video editing.

Pilot helps startups run world-class finance, including bookkeeping, payroll, taxes, and fundraising, powered by dedicated US-based experts and AI-driven insights *

📰 News

Apple is developing an AI wearable.

YouTube will soon let creators make Shorts with their own AI likeness.

ChatGPT will now predict how old you are, in an effort to protect young users.

X open sources its algorithm while facing a transparency fine and Grok controversies

💸 Fundraising

Zanskar raises $115 Million to find and develop Carbon-Free Energy Using AI.

Healthcare AI startup OpenEvidence raises $250M at $12B valuation.

French startup Mistral raises €1.7 billion, cementing AI lead in Europe

AI startup Humans& raises $480 million.

* sponsored

Fail(St)ory

The Merger Trap

Sendle spent a decade selling small businesses on shipping that didn’t make you lose your mind.

It raised over $100m, shipped tens of millions of parcels, expanded into North America, then shut down after a 2025 merger went bad. The ugly part was how fast it all snapped once trust and credit disappeared.

What Was Sendle:

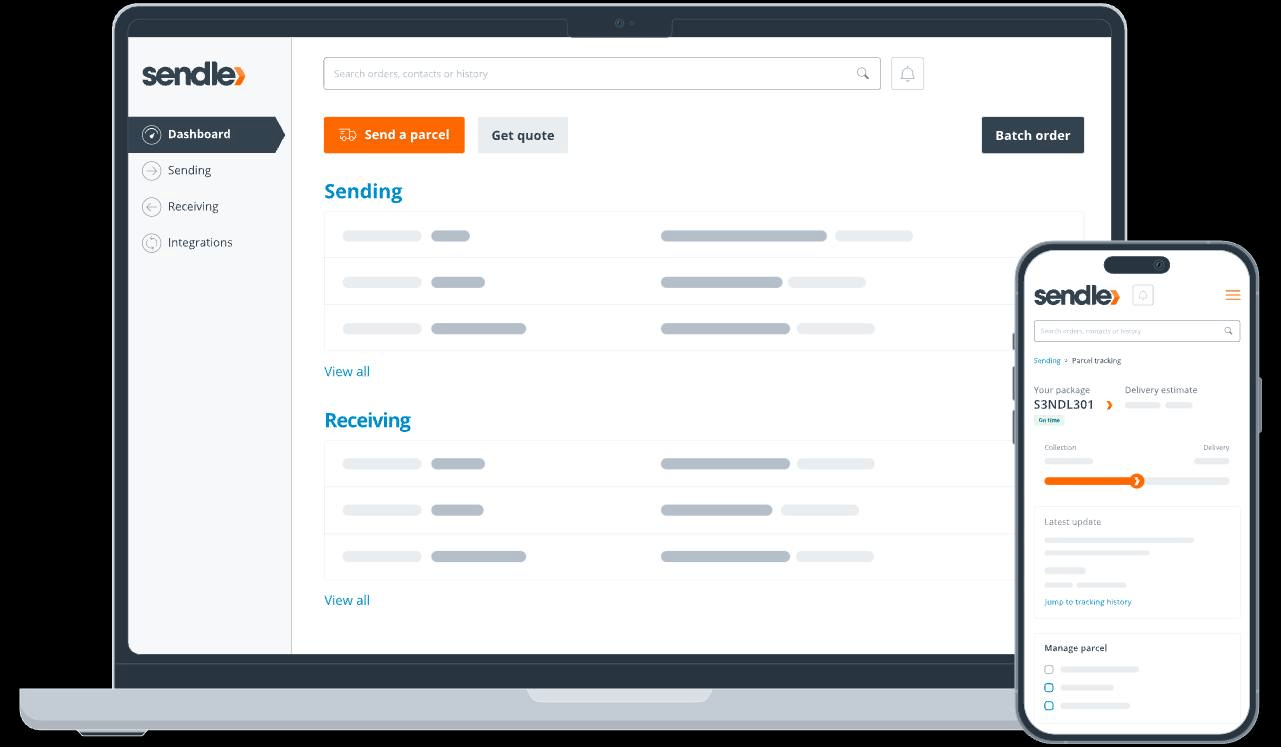

Sendle launched in Sydney in 2014 for small merchants who shipped every day and hated carrier friction.

In Australia, the default option for most businesses was Australia Post, the national postal service. Sendle positioned itself as the easier, cheaper alternative, with a cleaner experience for e-commerce sellers.

The company didn’t build its own fleet. It ran a software layer on top of third-party courier networks. Merchants bought the Sendle interface and pricing, while other operators did the physical delivery.

That model helped it grow. Sendle claimed it shipped more than 65 million parcels across Australia, the US, and Canada.

But the tradeoff was control. Service quality, costs, and reliability depended on partners. If a carrier tightened terms, raised prices, or had a bad week operationally, Sendle still owned the customer complaint.

Sendle expanded into North America in 2019. Reporting later pointed to burn and thin margins getting worse with aggressive headcount and marketing in the US.

By 2022, the pressure was visible. The company did layoffs and raised extra runway.

In August 2025, Sendle merged with two US delivery firms, ACI Logistix and FirstMile, under a new umbrella called FAST Group. The idea was to look bigger and move more parcels in the US.

Soon after, Federation Asset Management, a key backer, said it found ACI had unpaid bills that weren’t properly flagged during due diligence. Federation also said suppliers got fed up with late payments, which hit day-to-day performance.

At that point, partners tightened terms and cash got tight fast. FAST couldn’t raise enough to keep going, so the board shut Sendle down. Bookings stopped and merchants had to scramble.

The Numbers:

💸 Funding raised: $100m+

🗓️ Time operating: 12 years

🏙️ Founded: 2014, Sydney

🌎 Expanded: US + Canada in 2019

📦 Claimed volume: 65m+ parcels shipped

Reasons for Failure:

Partner dependence turned into a credit trap: Sendle’s asset-light model relied on third-party couriers to do the real work. That meant pricing, service levels, and payment terms were largely outside its control. When suppliers worried about getting paid, they protected themselves first.

US expansion likely amplified bad unit economics: The North America push came with higher burn and more complexity. Reporting pointed to thin margins per delivery and spending that outran contribution. If you grew by hiring and marketing before the economics held up, you needed constant funding to stay afloat. When funding tightened, the model didn’t have room to breathe.

The merger imported hidden liabilities: FAST Group was supposed to create scale and a stronger fundraising story. Instead, a key backer said ACI Logistix had unpaid obligations that weren’t disclosed properly during diligence. That kind of surprise spooked capital and tightened supplier terms at the worst time. Once confidence broke, raising emergency cash got ugly fast.

Why It Matters:

Mergers changed your failure mode. A company could manage its own burn, but it couldn’t easily absorb a partner’s surprise obligations.

Asset-light didn’t mean low risk. It shifted risk onto partners and credit terms. When those partners got nervous, the whole product wobbled.

Trend

Buy vs Build

The era of SaaS might be over. Or, not really. But something interesting is happening.

AI agents like Claude Code, Cursor, and the one I talked about last week — Claude Cowork — have made building custom tools stupidly easy.

The question companies are asking isn’t “which SaaS should we buy?” anymore. It’s now “can we just build this ourselves?”

Why it Matters

The build vs buy line moved. Internal tools that used to take quarters now take days.

SaaS pricing assumptions look fragile. If a $20k–$30k a year tool can be replaced by something internal that’s good enough, renewals get a lot harder.

What’s going on

In short: Claude Code is fricking amazing, and each week brings new examples that push the boundaries of “what this can do.”

In the last two weeks:

A principal engineer at Google experimented with Claude Code and had it build in one day something that had taken their team a year.

Anthropic built Claude Cowork in about 10 days using Claude Code.

The CEO of Cursor built an entire web browser using Cursor in a single week. I’m talking 3M+ lines of generated code across thousands of files. Here you can see the agent in action.

If an agent can spit out a functioning web browser, it can absolutely build:

a reporting dashboard

an internal CMS

a lite analytics pipeline

a custom ops tool

…often faster and cheaper than buying a SaaS and onboarding it.

And the market is starting to notice

Software stocks haven’t behaved like you’d expect in an AI boom.

Traditional SaaS names are lagging, even as AI infrastructure and broader tech do fine. According to Morningstar, many software companies now trade 20% or more below historical valuation levels. Not because revenues collapsed, but because investors are nervous about AI changing demand.

Big enterprise names like Salesforce, ServiceNow, and Adobe have all looked weak on the charts. The thinking is straightforward: if teams start building smaller tools internally, renewals get harder and seat growth slows.

You also see this fear surface in real time. After the launch of Claude Cowork, both Bloomberg and MarketWatch tied the product directly to software selloffs, framing it as a sign that AI generalists could eat into specific SaaS categories

The Trend

The real shift is pretty simple.

A growing chunk of software spend was never about “software.” It was about convenience. Paying so teams didn’t have to build small, annoying tools themselves.

That tradeoff is breaking down. Agents make it cheap to build internal tools that are specific, ugly, and good enough.

This doesn’t kill SaaS. But it pressures the parts of SaaS that relied on being “easier than building.” That advantage is thinner than it was six months ago.

Help Me Improve Failory

How useful did you find today’s newsletter?Your feedback helps me make future issues more relevant and valuable. |

That's all for today’s edition.

Cheers,

Nico